A failed payment can be a nightmare for an ecommerce or membership site owner. In fact, any situation that poses a threat to your income can become stressful fast. However, staying calm when you encounter a failed transaction can help you quickly resolve the issue.

In this article, we’ll take a look at why payments fail and what effect it can have on your business. Then we’ll share three tips for handling payment failures on your website.

Let’s go!

Understanding Why Online Payments Fail (And How It Impacts Your Business)

Your online store or membership site probably accepts credit card payments. After all, this is the easiest way to enable customers to check out on your site, or to automatically charge monthly or annual membership fees.

However, there are several reasons online card payments might fail. To start with, your customer may be using a card that has a spending limit, or is connected to a bank account that does. Insufficient funds to cover the cost of their purchase will likely result in a declined payment.

It’s also possible that your customer or member’s card has expired or has been canceled, and they’ve forgotten to update their information. Or the bank may have placed a hold on their card due to suspected fraudulent charges, either on your site or elsewhere.

It is possible that a problem with your site, payment gateway, or membership plugin could prevent payments from going through. However, more often it’s simple human error causing the problem. This means that fixing the issue is just a matter of communication.

The bad news is that declined payments can still have a negative impact on your site, even if they aren’t your fault. The most obvious issue is that they delay your income. If you are relying on a certain amount of revenue to handle your bills, and suddenly experience a lot of failed transactions, having your money tied up this way could become a serious issue.

Additionally, if you don’t have a way of knowing when payments fail on your membership site, you could lose members because of it. Accounts with unpaid fees due to failed payments could be closed, for example. If you and the account holder don’t take prompt action, failed payments could make it hard to grow your site.

How to Handle Failed Payments on Your Ecommerce or Membership Site (3 Key Tips)

When it comes to dealing with failed payments, one of the best things you can do is prevent them from happening in the first place. Fortunately, there are several measures you can put in place to avoid failed payments, and to deal with them quickly if they do occur. Let’s look at three of the best steps you can take.

1. Put Preventative Measures in Place to Avoid Failed Payments

One of the easiest ways to avoid having to deal with payments failing on your site is to enable your customers or members to edit their payment method information. This will help avoid declined payments due to expired cards.

There are several plugins for WordPress that include this feature. WooCommerce Subscriptions enables customers to modify their credit card information, as do MemberPress and Paid Memberships Pro:

You can also set up email notifications, to let your members or customers know when their preferred card is about to expire. This will prompt them to take care of the problem without having to involve you at all, so you can focus on the other tasks that are necessary for running your site.

2. Make Sure You and the Customer Are Notified About Failed Payments

Some plugins don’t enable users to edit their payment methods. Plus, even with the above measure in place, occasional payments may fail anyway. In those cases, email notifications are still key. By alerting you to the fact that a problem has occurred, failed payment notifications can help you resolve the issue as fast as possible.

Paid Memberships Pro, MemberPress, and WooCommerce Subscriptions all have features for enabling email notifications regarding declined payments, for both you and your members or customers. If you’re using a different membership site plugin or aren’t running a subscription service, however, notifications are slightly more complicated.

In large part, whether you and your customers receive failed transaction notifications could depend on the payment gateways you’re using. Some gateways, such as Stripe, will automatically send emails to alert you and your customer to the problem.

However, other popular gateways – including PayPal – do not have this feature. In those cases, you might consider investing in a payment recovery service. These platforms generate automated emails to help you contact customers regarding failed payments.

Churn Buster is a useful solution, as it offers integrations with Stripe, PayPal, and WooCommerce:

It can also help you retry payments before sending emails to your customers. This way, you can automatically solve some failed payments without having to involve anyone else.

3. Work With the Customer and Payment Gateway to Retry the Payment

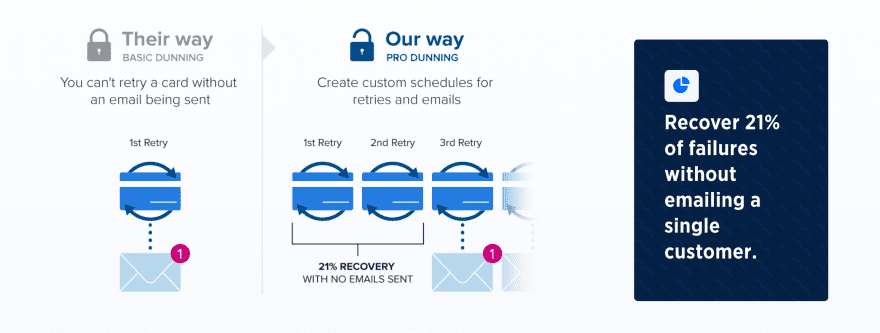

After a payment fails, you’ll need to retry the transaction. Depending on the tools you’re using to manage your site, you may be able to automate this process. Stripe, for instance, will automatically retry a payment a few days after it fails, as will Churn Buster:

If you can’t set up automated retries, or if the payment fails again, you’ll need to get in touch with the member or customer in question. Keep in mind that, even with email notifications set up, they may not have realized there’s a problem with their payment method.

This is why it’s best if your first direct email to your customer or member avoids any accusatory language. Being polite and diplomatic will help you maintain a good relationship with your user while solving the problem. Simply ask them to update their information, transfer more funds to their account, or contact their bank about allowing the transaction. In many cases, this simple prompt is all that’s needed to resolve the issue.

Conclusion

There’s no doubt that failed payments can cause stress for website owners. However, keeping your cool and calmly handling the situation can help turn things around, and create a positive outcome for you and your customers or members.

Three of the key tips for handling failed payments on your ecommerce or membership site include:

- Putting preventative measures in place to avoid failed payments.

- Making sure you and the customer are notified about failed payments.

- Working with the customer and payment gateway to retry the payment.

Do you have any questions about handling failed payments? Let us know in the comments section below!

Article Thumbnail Image Javid Kheyrabadi / shutterstock.com

The post How to Handle Failed Payments on Your Ecommerce or Membership Site appeared first on Elegant Themes Blog.